How to Create a Loan App: Understanding the Basics and Key Considerations

Banking and financial industry is constantly evolving, thanks to innovative technologies. Not long ago, obtaining a loan was tedious and time-consuming, packed with paperwork, long queues, and countless bank visits. However, with technology’s rapid advancement and loan apps’ emergence, the landscape has transformed dramatically. According to research, the global personal loans market is projected to reach $719.31 billion by 2030, growing at a CAGR of 31.7%. Similarly, in the aftermath of the COVID-19 pandemic, the number of users of loan lending apps has risen by 25%. Does the tremendous growth of the personal loan market entice you to invest and grab a share in massive profitability? Do you know what is exactly a loan app? Or how to create a loan app?

Now, equipped with a smartphone and a few taps on the screen, individuals can easily access loans. These loan apps utilize cutting-edge algorithms and artificial intelligence to assess creditworthiness swiftly, eliminating the need for extensive documentation. With personalized loan offers tailored to each user’s financial profile, the apps provide convenience, speed, and transparency. Borrowers can submit applications through secure digital platforms, receive instant approvals, and disburse funds directly into their bank accounts. The days of lengthy waiting periods have been replaced with a seamless and efficient experience, enabling people to fulfill their financial needs with just a few taps.

This article covers crucial details about how to create a loan app. Read our article to know more.

Key features of loan apps

Money lending apps offer a great user experience and ensure convenience and speed. Though the specific features of loan apps might vary, the primary components are indispensable for every loan app. The following is a list of primary elements of loan apps.

User Registration

A loan app must have a user registration process that collects essential information from borrowers, such as names, contact details, employment information, and identification documents. It should also allow users to create and manage their profiles to enter personal information and monitor their loan history.

Loan application process

The loan app should offer a simple and user-friendly loan application process. It should guide borrowers through the necessary steps, including providing loan details, selecting loan amounts and repayment terms, and submitting required documents. The process should be transparent, minimizing any confusion or complications.

Eligibility check

The loan app should have an eligibility check feature to ensure borrowers meet the necessary criteria. This feature evaluates factors like credit score, income level, and employment history to determine if the borrower qualifies for a loan.

Document verification

Borrowers should be able to upload the required documents directly through the loan app. These documents may include identification proof, income statements, bank statements, and address verification. The app should securely handle the document upload process and verify the information.

Loan tracking

A loan lending app should provide borrowers with real-time updates and notifications regarding the status of their loan applications. This feature keeps borrowers informed about the progress of their application.

Notifications

Push notifications provide reminders and personalized information that can remind borrowers about upcoming repayment dates and provide information on outstanding dues, new profitable loans, and other refinancing options.

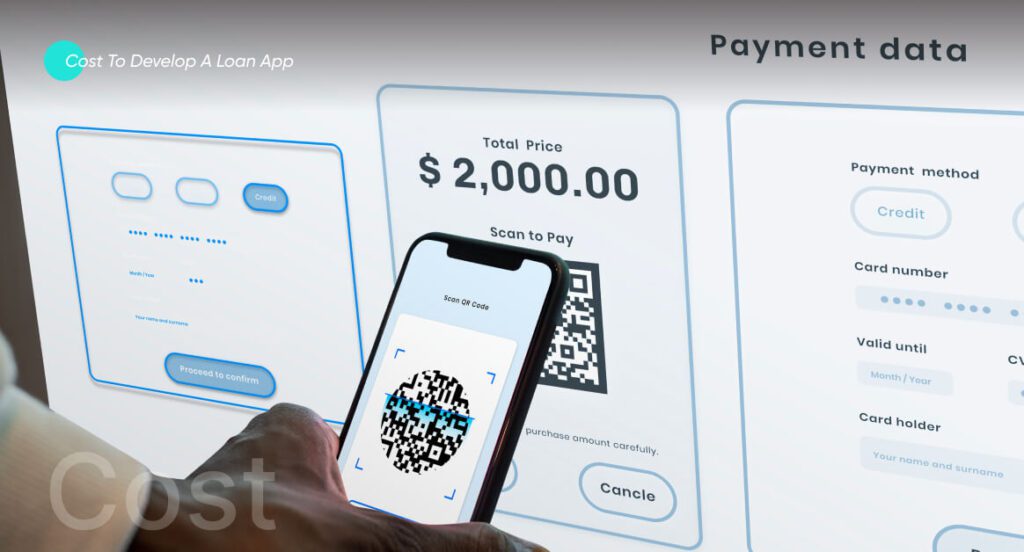

Secure payment gateways

A mobile loan app must integrate secure payment gateways to facilitate loan disbursal and repayments. It should support various payment options, such as credit/debit cards, net banking, and mobile wallets, to offer flexibility to borrowers.

Credit score

The credit score feature in a loan app allows borrowers to access and monitor their credit scores, helping them understand their creditworthiness and make informed decisions when applying for loans, improving their chances of loan approval and favorable terms.

Loan Calculator

Including a loan calculator feature helps borrowers estimate the monthly installments, interest rates, and the total repayment amount based on the loan amount and tenure. This feature enables borrowers to make informed decisions about their loan applications and plan their finances accordingly.

Customer support

An effective loan app should provide reliable customer support channels like in-app chat, email, or phone support. Borrowers should be able to seek assistance, ask questions, and resolve any issues related to their loan application or repayment. Prompt and responsive customer support contributes to a positive user experience.

Security and privacy

Loan apps deal with sensitive financial information, so robust security measures are crucial. The app should incorporate data encryption, safe storage practices, and compliance with data protection regulations to ensure user privacy and safeguard against unauthorized access or data breaches.

Personalized recommendations

A loan app that offers personalized loan recommendations based on the user’s financial profile and requirements can be highly beneficial. The app can suggest suitable loan products and terms by analyzing user data, income, and creditworthiness, making the borrowing process more tailored to individual needs.

Advantages of loan apps

If you are mulling over how to create a loan app, then you should know about its advantages. Loan apps owe their popularity to their various benefits, including convenience and easy accessibility to loans. The following are the advantages of loan apps.

The simple and convenient application process

Loan lending apps offer a streamlined and convenient application process. Users can apply for a loan through the loan app, without the hassle of leaving their homes and from any location with an internet connection. Additionally, you can submit the online form and necessary documents through the loan app. Loan apps offer benefits by avoiding the need for physical documentation and delays because of the conventional loan-seeking process.

Fast approval and disbursal

A crucial advantage loan apps provide compared to traditional loan-seeking methods is the precision at which loans are approved and distributed. Thanks to the well-integrated advanced algorithms and automated processes that analyze loan apps and provide quick loan approvals. The app swiftly transfers these loans into the user’s bank account, which is advantageous for users beset by an immediate financial emergency.

Increased financial inclusion

Money lending apps also play an instrumental role in accelerating financial inclusion by providing access to money for unbanked or underbanked individuals who may not have access to banking services. In addition, loan apps employ novel credit scoring models to evaluate the creditworthiness of users. These models include repayment history, transaction history, and mobile phone usage. These models help to expand financial inclusion to a more significant population.

Personalized loan offers

Loan mobile applications create personalized loan offers for borrowers using innovative algorithms and data analytics. These apps evaluate an applicant’s financial profile, including income, expenses, transaction, and repayment history, to ascertain the apt loan amount, interest rates, and repayment terms. These personalized offers substantiate that borrowers receive loans per their distinct requirements, embellishing the entire borrowing process.

Maximized security

Robust privacy and security measures augment loan apps to protect sensitive personal and financial information. These measures include encryption, secure data storage, and strict data protection protocols to protect user data from unauthorized access and misuse.

Clear terms and conditions

Most loan mobile applications usually display clear terms and conditions to borrowers. It includes essential information about the loan policy, repayment terms, interest rates, fees, and other relevant information. This form of transparency offered by the loan apps assists borrowers in making prudent decisions about borrowing money from a loan app.

The development process for creating a loan app

Creating a loan app involves several development steps. The following is a list of general steps involved in the development process of a loan app.

The development process for a loan app is a multiphase process. It starts with an idea and then goes through various stages until the process concludes. Here are the key steps that are involved in the creation of a loan app.

Ideation

Start by highlighting the requirements of your mobile loan application. Determine the target audience, the features and functionalities, the types of loans, and any regulations or compliance that must be observed. Similarly, conduct thorough market research and identify your competitors, assess the strengths and weaknesses of their loan apps, and decide about your app’s unique selling proposition (U.S.P.).

Design

In the second phase, you should design your loan app’s user interface (U.I.) and user experience (UX) by creating wireframes and prototypes. You must ensure that the U.I. and UX of your app are user-friendly, responsive, and intuitive. If your app incorporates these features, it will likely appeal to your target audience.

Development

The development phase entails the work on backend and frontend development.

Backend app development focuses on building an application’s server-side components and logic. Frontend app development, on the other hand, deals with the client-side aspects of an application. You are required to develop the backend architecture of your loan app, such as developing databases, designing APIs, and applying server-side logic.

Here, you pick adequate programming languages such as Python and Java. On the other hand, frontend development entails implementing the user interface design using technologies such as HTML, CSS, and JavaScript frameworks like React, Angular, or Vue.js. You must ensure the app works smoothly on numerous devices and screen sizes.

Testing and Launch

In this phase, it is essential that comprehensive testing is conducted to identify bugs, errors, or other issues and fix them. It is advisable to perform functional, user acceptance, and security testing to ensure the mobile loan application runs flawlessly.

In the final stage, the app will be deployed on appropriate platforms such as iOS, Android, or others. Adherence to guidelines is recommended to ensure your app’s success. Afterward, consistently monitor and maintain the app by dealing with performance issues and user feedback, and also release regular updates, new features, and security patches.

Interested in Knowing How to create an Investment App? See our Latest Blog Exploration on it! ![]()

Top 5 loan mobile applications

EarnIn

One of the leading apps for borrowing money is Earnin. It’s an option called ‘Cash Out’ that allows you the convenience of accessing your paychecks early. Users can acquire up to $100/day or $750/paycheck to cover expenses. Earnin is cost-effective as it charges zero interest and no mandatory fees and helps users avoid overdraft fees or payday loans.

Dave

Dave offers the ease of borrowing up to $500 per period to avoid overdraft fees or bearing minor expenses. Although the app doesn’t charge interest, it offers a membership fee of $1. Dave has no minimum balance requirement and provides other benefits such as budgeting tools and credit-building services.

Brigit

Brigit is a money lending application that offers an advance loan of up to $250 to facilitate customers’ access to quick money (in about 20 minutes) to avoid bank overdraft fees. Brigit doesn’t charge interest; contrarily, customers must buy its Plus Plan for a monthly cost of $9.99. In return, customers can reap the benefits of features such as $1 million identity theft insurance, budgeting tools, access to reports, and important notifications.

SoFi

SoFi offers various financial products like personal loans, mortgages, and investment options. Customers can borrow loans from $5000 to $100,000 on the same day. SoFi doesn’t charge accounts, overdrafts, minimum balances, and monthly fees. When customers become members, they become eligible for numerous perks, including financial planning and career mentoring.

CashApp

CashApp is a P2P loan mobile application allowing users to send and receive stocks and bitcoin through mobile phones. Customers can access paychecks up to two days early and also use free A.T.M. withdrawals if they have $300 in their app account each month. You must be older than 18 to use CashApp, send money, and pay for services.

How much does it cost to develop a loan app?

The cost of creating a loan app depends on several factors, including the complexity of the app, the number of features, the technology stack, the development team’s rates, the location of the development team, and the time required for completion. A loan app with moderate complexity and standard features could cost you between $5,000 to $20,000. A loan app with slightly advanced features could cost you between $20,000 to $ 50,000. Finally, a loan app with highly advanced and complex features could cost over $50,000.

Partner with us to build a scalable, robust, and feature-rich loan app. See our application development services ![]()

FAQs

Which are the fastest loan apps?

Some loan apps are known for their quick processing times. They include KreditBee, EarlySalary, MoneyTap, and PaySense.

Can a loan app provide real-time updates on loan approvals and disbursements?

A loan app can provide real-time updates on loan approvals and disbursements by leveraging digital platforms and automated processes. It enables borrowers to receive instant notifications about their loan application status, ensuring transparency and efficient communication between lenders and borrowers.

Can loan apps integrate with banking systems for seamless fund transfers?

Loan apps can integrate with banking systems to enable seamless fund transfers. By establishing secure connections and utilizing APIs, loan apps can facilitate direct transfers between the lender’s account and the borrower’s bank account, eliminating the need for manual intervention and streamlining the disbursement process. This integration ensures swift and efficient movement of funds, enhancing the overall user experience.

Are loan apps secure for sharing personal and financial information?

Loan apps prioritize security measures to protect personal and financial information. They employ encryption protocols, secure connections, and stringent data protection practices to safeguard user data from unauthorized access or breaches. Additionally, loan apps adhere to privacy regulations and industry standards, ensuring high trust and confidentiality for users’ sensitive information.

Are loan apps suitable for both individuals and businesses?

Yes, loan apps are suitable for both individuals and businesses. They offer a range of loan products tailored to meet the specific needs of individuals seeking personal loans or businesses looking for funding solutions. Loan apps provide convenience, flexibility, and accessibility to various borrowers, catering to their unique financial requirements.

Gohar is a seasoned IT writer specializing in leading technologies. He holds a Diploma and Bachelor's degree from the University of London, with professional experience spanning over five years in the IT sector. His expertise involves a keen focus on mobile applications, web apps, blockchain, content management systems, e-commerce, and fintech. Beyond the professional field, Gohar is an avid reader and reads extensively about emerging and innovative technologies.